Top-up existing loan

Top-up existing Loan

a top-up existing loan refers to the facility provided to employees who have an active loan to apply for additional funds beyond their initial loan amount.

Top-up existing loans offer convenience to employees who require additional funds without the hassle of applying for a new loan. However, employees should carefully consider the terms and conditions of the top-up facility, including interest rates and repayment terms, before availing of it.

To view the Top-up/revise screen, Login to SPARC > Menu > Loans

Steps to Top-up/revise:

- Login to SPARC as HR

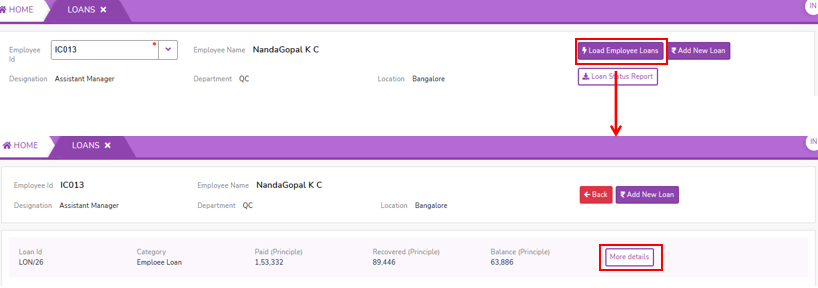

- Navigate to the Util menu and click on the 'Loans' function. A screen similar to the one below will open, where you can select the Employee ID from the dropdown menu.

- When clicking on Load Employee Loans, if the employee already has an existing loan, proceeding to More Details will direct you to the existing loan status, as shown in the screen below

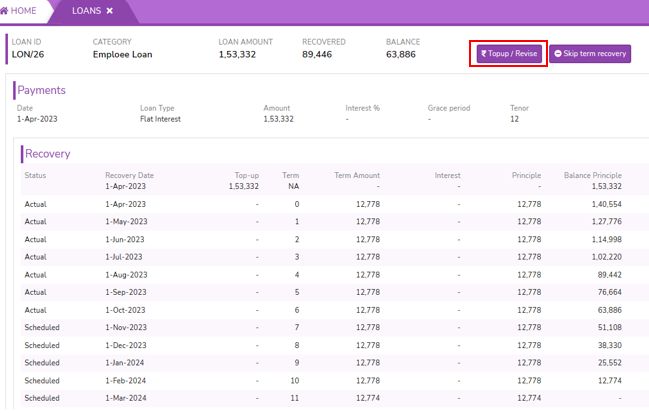

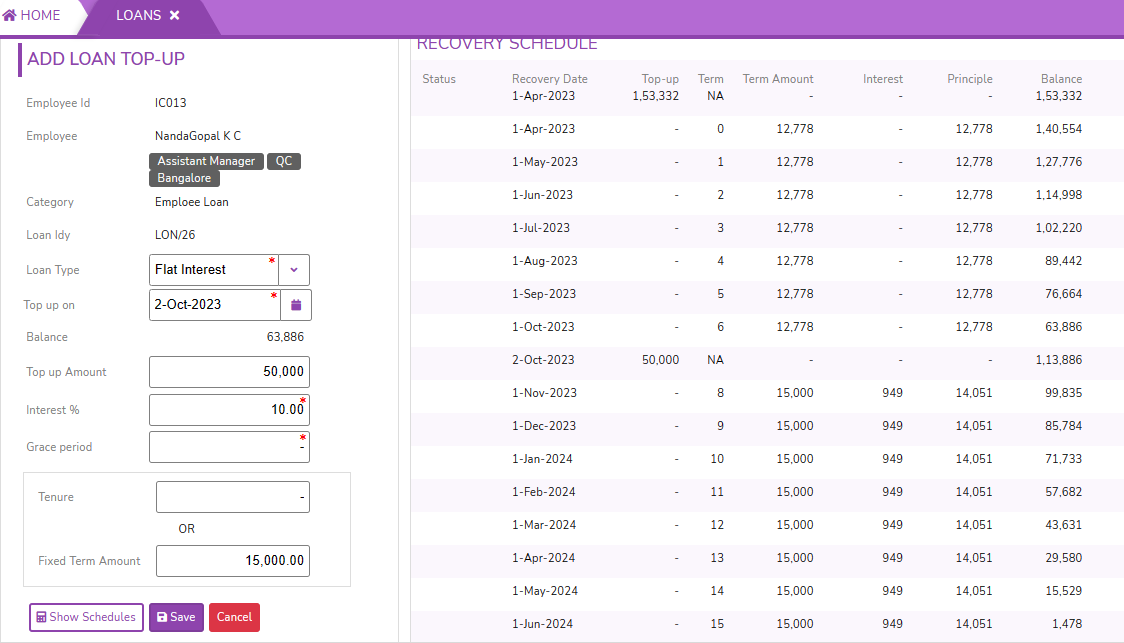

- The above screen displays the existing loan status of the employee. If the employee requires additional funds beyond their initial loan amount for their financial needs, they can opt for a top-up loan on their existing loan. To do so, click on Top-up/Revise. This action will direct you to the screen for adding a top-up loan, as shown below.

- Click on Save button to save and submit the top-up loan to the existing loans.

- Click on the Cancel button to abandon or decline to submit the top-up loan to existing loans.

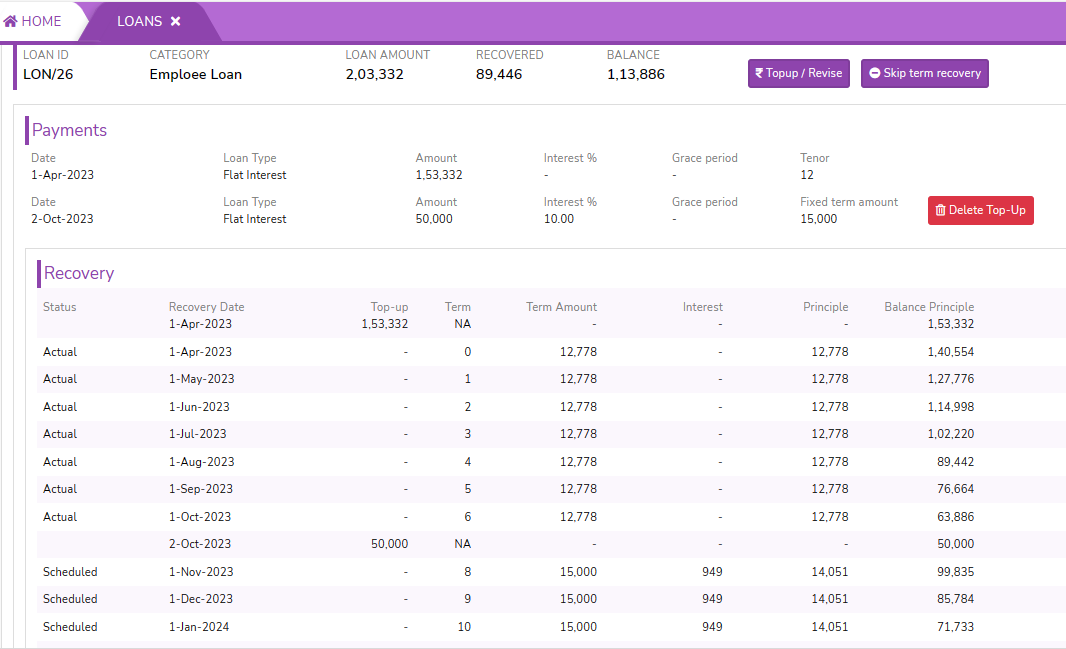

- After saving, the screen will appear as shown below. Navigate to More Details to view the total loan amount, the amount recovered to date, and the remaining balance. Additionally, immediately after submitting the top-up loan without any deductions, you have the option to delete the top-up loan using the Delete Top-up function.

No Comments