Form16

Form16

Form 16 is a document that is typically generated and provided by an employer in India to its employees. It contains details of the employee's salary, tax deductions, and other income-related information, which is required for filing income tax returns.

The Form16 page in the SPARC allows you to view, generate(bulk/individual) and process the Form16 for the employees.

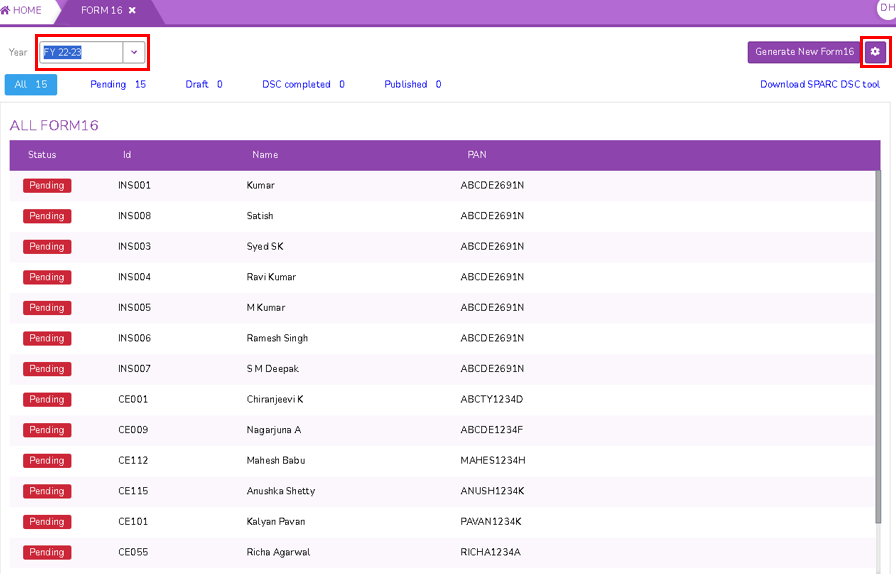

To view the Form16 page, Login to SPARC > Functions > Click on Util > Form16.

You can perform the following steps on the Form16 page:

Overview:

Step-1:

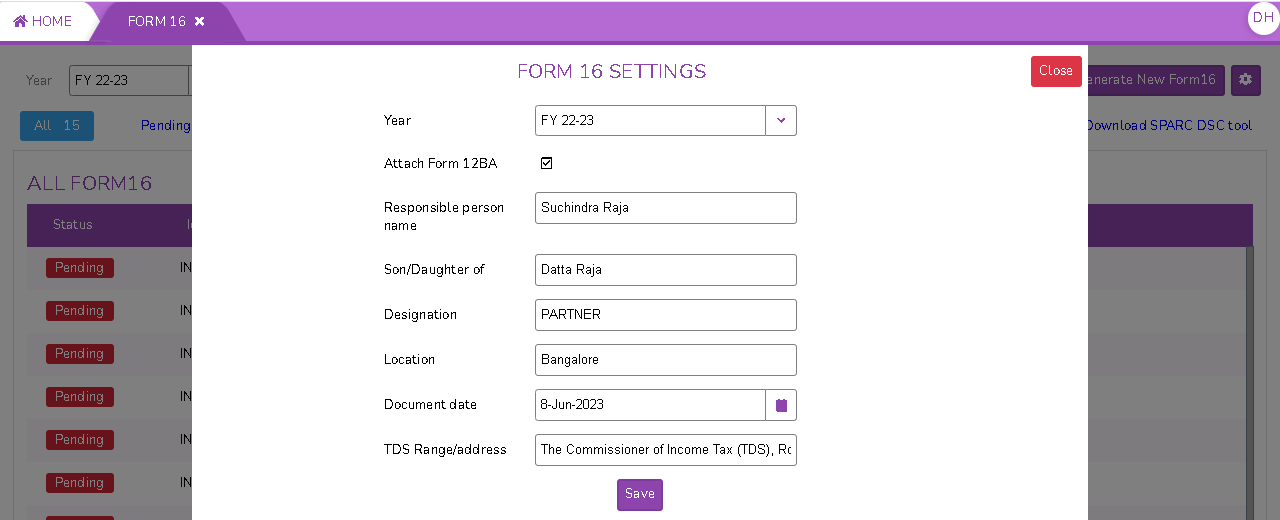

- Click on settings button as shown above picture to fill additional details and the screen opens like below

- Attach Form12BA : Click on Check box to attach Form12BA

-

Form 12BA: Form 12BA is a statement of particulars required to be furnished by an employer to their employees. It is a supporting document provided along with Form 16 and is used to provide additional details about the perquisites and other fringe benefits provided to the employee during the financial year.

- Responsible person name: Name of the responsible person/ Employer

- Son/Daughter of: Father's name of the responsible person

- Designation: Designation of the responsible person

- Location: Where is he/she located

- Document Date: Date of document generated

- TDS address: Address of TDS office who issued Form16

- Click on Save button to save the Form16 settings.

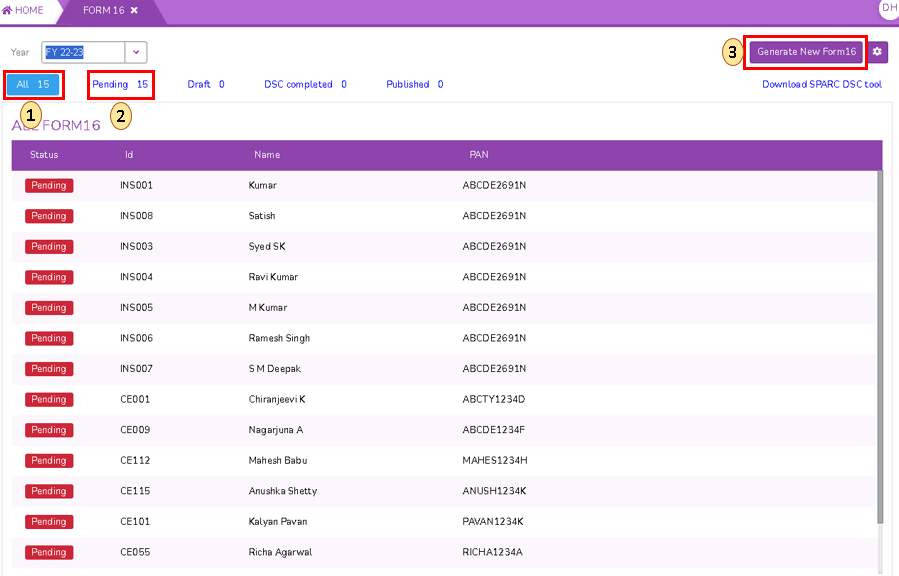

- In this overview screen, It shows us All, pending, Draft, DSC completed and published.

- Here it is showing Pending 15 means 15 employees are yet to generate New Form16 for the selected financial year.

- Click on Generate New Form16, It looks like below Screen

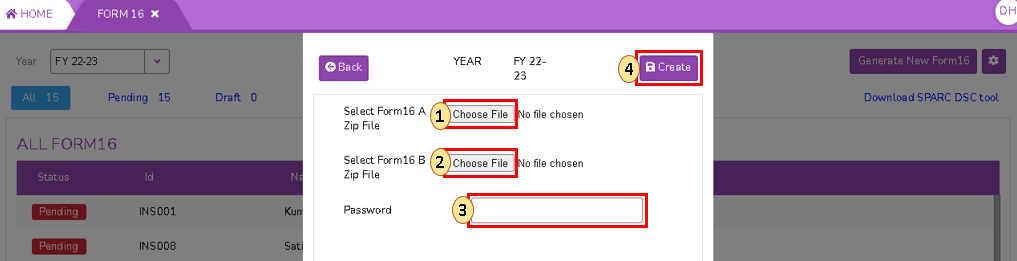

Form16A : It is a certificate of the tax deducted at source (TDS) from the income earned by the employee. Form 16A is specifically related to TDS on income other than salary.

Form16B : It is a certificate that is related to the sale of property and the tax deducted at source (TDS) on the proceeds from the sale.

-

- Select and upload Form16 part B zip which was downloaded from income tax portal

- Select and upload Form16 part B zip which was downloaded from income tax portal

- Enter the password to open zip file

- Click on Create to Generate New Form16.

No Comments