Payroll

Payroll refers to the process of managing and processing employee compensation, including wages, salaries, bonuses, deductions, and taxes. It is an essential function within any organization that employs workers. The payroll process involves calculating employee earnings, deducting taxes and other withholdings, and ensuring that employees receive their correct net pay.

Some of the components of payroll are -

- Gross Pay, also known as gross earnings or gross income, refers to the total amount an employee earns before any deductions or taxes are withheld. It includes all forms of compensation, such as regular wages or salary, overtime pay, bonuses, commissions, and any other income sources related to employment.

- Deductions, Withholding various taxes (e.g., income tax, Social Security, Medicare) and other deductions (e.g., health insurance premiums, retirement contributions) from employees' gross earnings.

- Reimbursements, Reimbursements refer to payments made by an employer or another entity to cover expenses that an individual has incurred on their behalf. some of them are business travel expenses, office supplies, fuel expenses, equipment or technology etc.,

- Taxes, refer to the various taxes that are withheld from an employee's gross pay to fulfill tax obligations. Both employees and employers have tax responsibilities, and the payroll process is used to facilitate the collection and payment of these taxes.

- Net Pay, It is the total amount that an employee receives after all required and voluntary deductions are taken out.

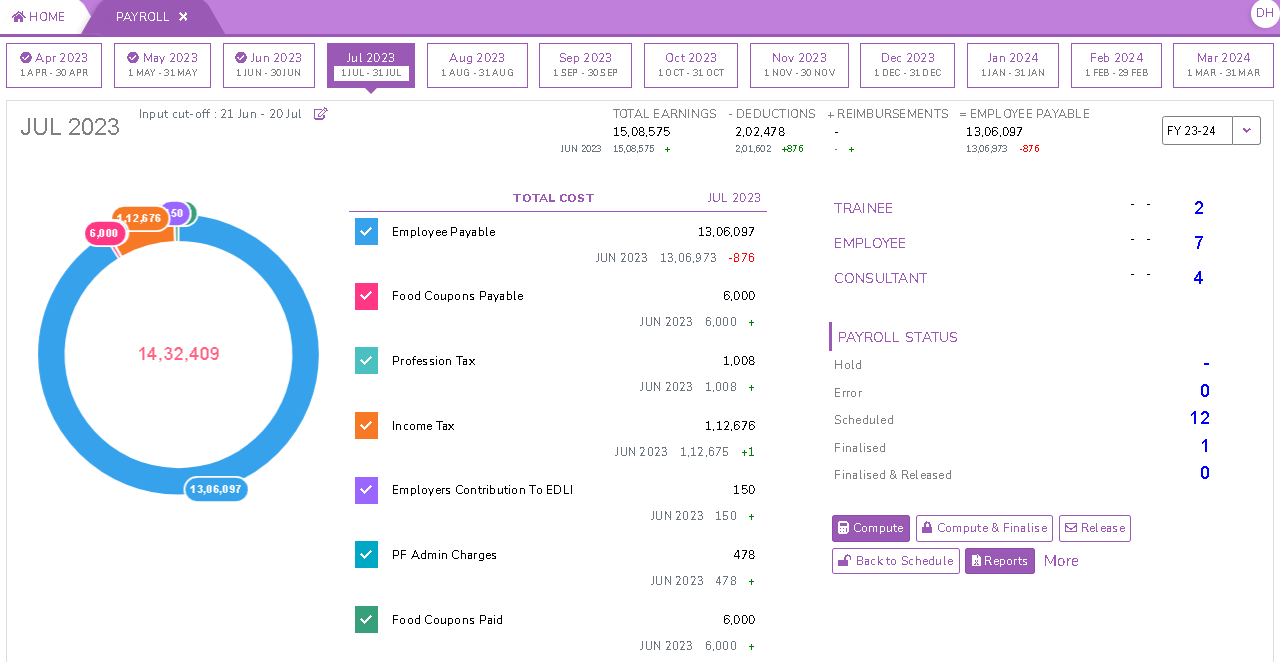

The payroll page in the SPARC allows you to view, add(bulk/individual) and delete the payroll process of the employees.

To view the payroll page, Login to SPARC > Menu > Click on Payroll group> Payroll

- Login to SPARC as HR.

- Open the Payroll menu. Here you can see all the payroll payment details

- Select the financial year and month of the payroll you wanted to process/review.

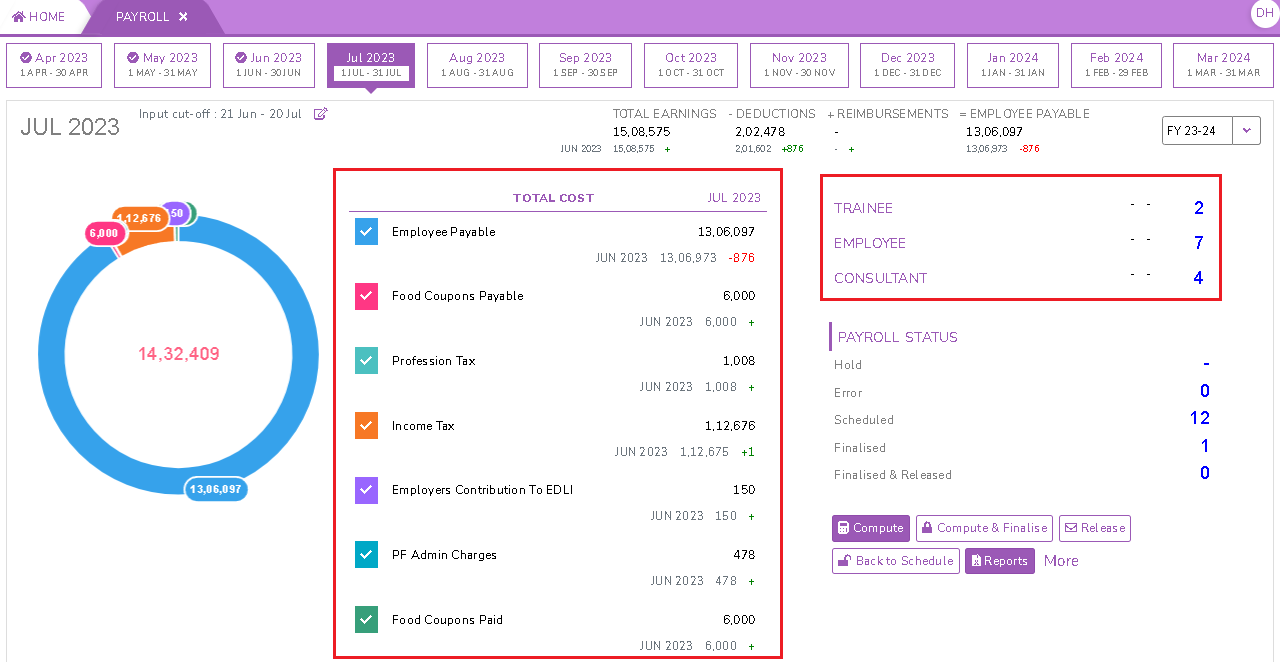

- Total cost for the selected month for the total number of employess includes:

- Employee Payable: The amount payable to the employee for the selected month.

- Food coupons payable: refers to the liability or amount owed by a company or employer to a food coupon vendor for the food coupons or meal vouchers provided to its employees.

- Profession Tax: It is a form of direct tax, and the rates and rules associated with profession tax vary from one state to another.

- Income Tax: Is a form of direct tax levied by the government on an individual's or entity's income.

- Employers Contribution to EDLI(Employee's Deposit Linked Insurance) : The scheme aims to provide life insurance coverage to employees who are members of the Employees' Provident Fund (EPF) in the unfortunate event of their demise during their employment.

- PF Admin Charges : PF admin charges refer to the administrative charges levied by the Employees' Provident Fund Organization (EPFO) in India for managing the provident fund accounts of employees and various administrative functions related to the Employees' Provident Fund (EPF) scheme.

- Food coupons paid : refers to the amount of money or funds that a company or employer has disbursed or spent on providing food coupons or meal vouchers to its employees.

-

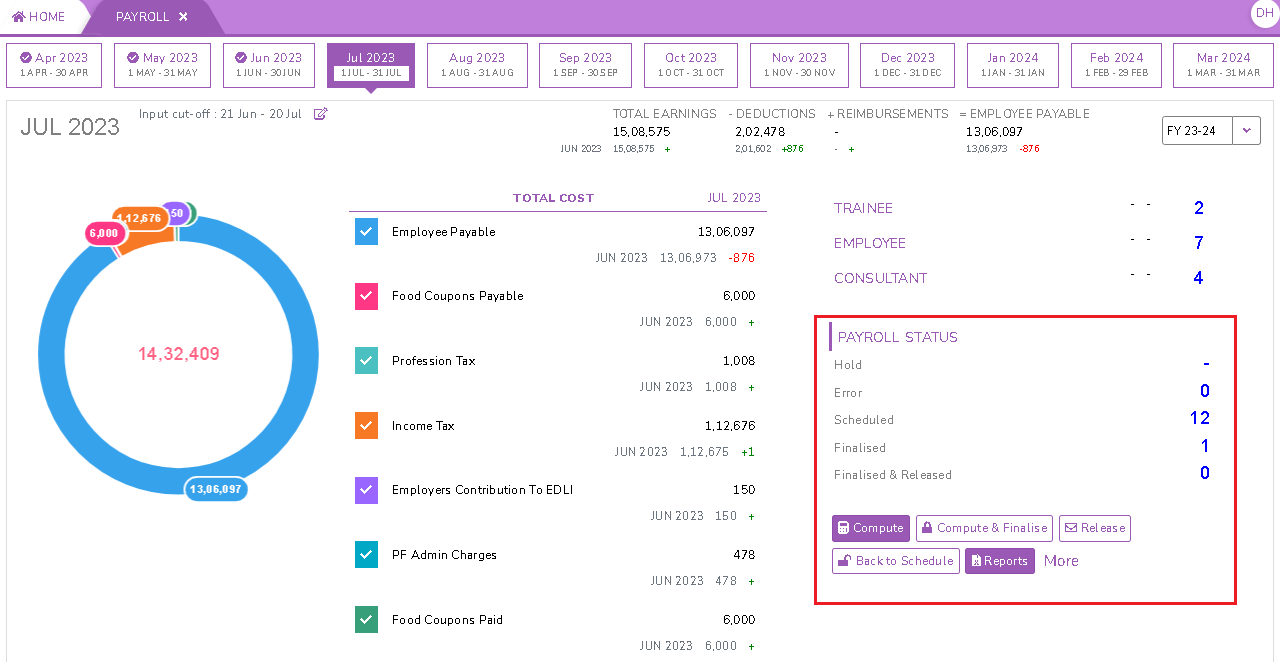

Payroll Status: refers to the current state of an employee's payroll for the selected month/period. Payroll status can be computed in individual employee/ bulk.

- Payroll status computation individual employee

- Hold:

- Error:

- Scheduled: Scheduled for payroll computation

- Finalised: Payroll computation completed and finalised/locked

- Finalised and released: Payroll computation and released to employees. Released means employees can see their payroll/payslips in their ESS portal. Payslips will be sent to employees via email.

- Payroll status computation in bulk

- Compute: compute the payroll status for scheduled employees.

- Compute and Finalise: Payroll computation completed and finalised/locked for all the employees.

- Release : Payroll computation and released to all employees. Released means employees can see their payroll/payslips in their ESS portal. Payslips will be sent to employees via email.

- Back to schedule: If you felt any correction in computation after release, you can refer/correct the payroll computation by clicking the back to schedule.

- Reports: Download the reports like payslips, payroll computation sheets, IT statements, PF reports and workings etc.,

- More: more options like compute without arrears and migrate payroll.

- Payroll status computation individual employee

No Comments