Employee Payroll

Employee Payroll

It is the process by which an employer calculates and distributes compensation or salaries to its employees. It encompasses all the financial aspects of paying employees for their work, including wages, salaries, bonuses, deductions, and benefits.

The Employee Payroll page in the SPARC allows you to view and delete the payroll process of the employees.

To view the Employee Payroll page, Login to SPARC > Functions > Click on Payroll > Employee Payroll.

You can perform the following steps on the Employee Payroll Inputs page:

- Employee Payroll Computation in Bulk

- Employee Payroll Computation for each Employee

1. How to Add Employee Payroll Computation in Bulk

- Login to SPARC as HR.

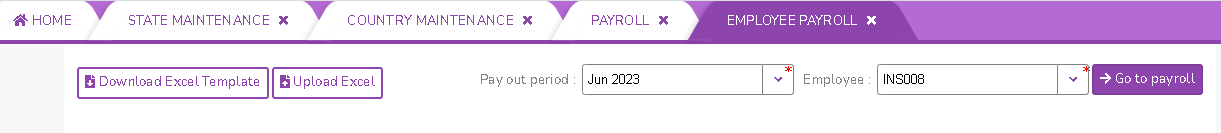

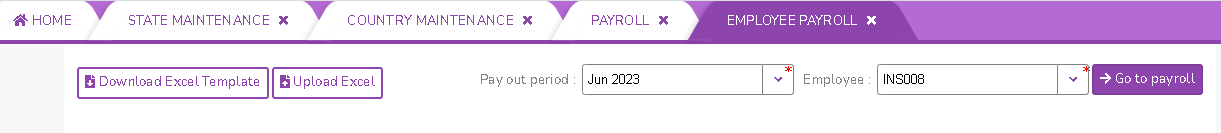

- Open the Employee Payroll menu. The screen opens like below

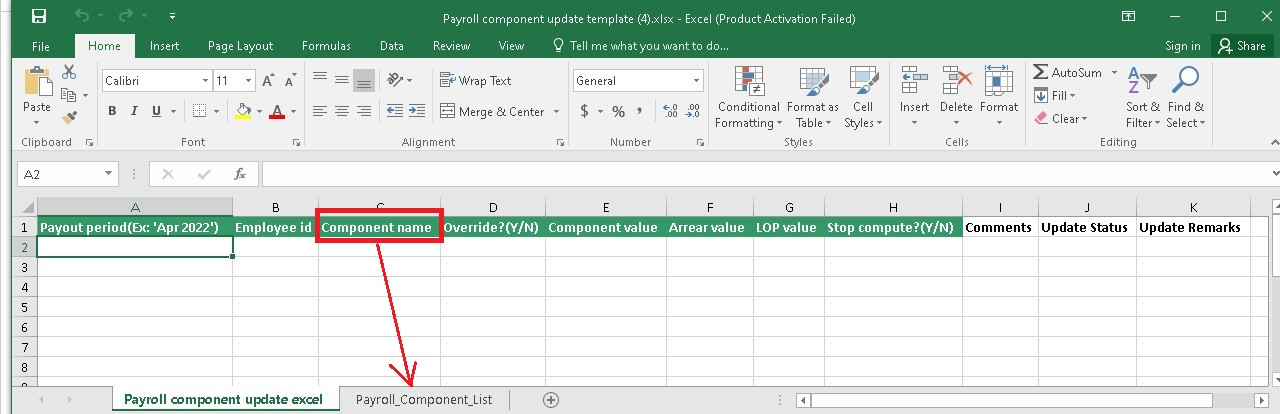

- Click on Download Excel Template for payroll computation of all the employees. You can see the excel format worksheet was downloaded in the downloads. and the downloaded excel will be looks like below screen

- Click on Upload Excel from there choose payroll component file and Upload for employee payroll computation in bulk.

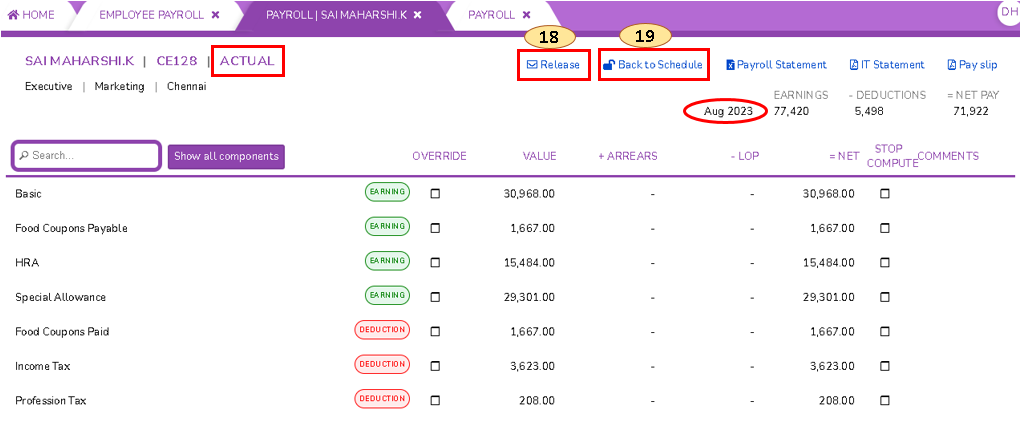

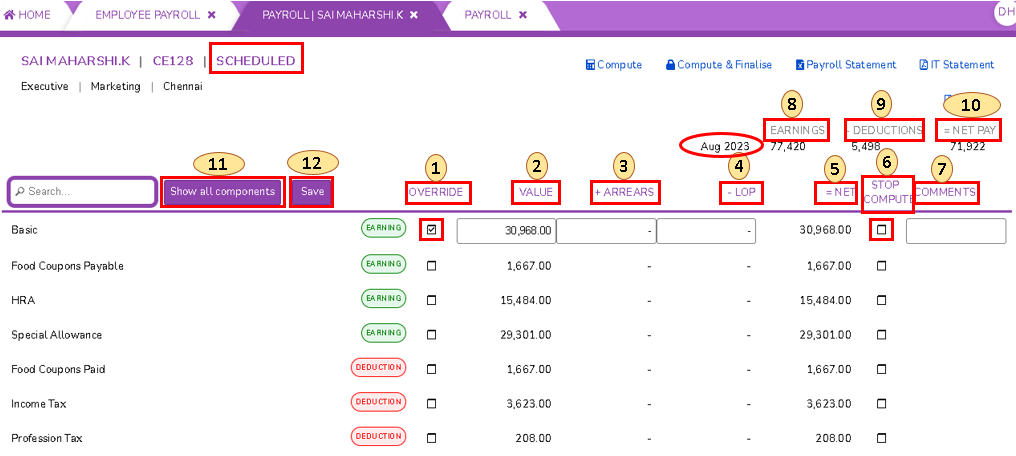

2. How to do Payroll Computation for each Employee

- Login to SPARC as HR.

- Open the Employee Payroll menu. The screen opens like below

- Select the correct Payout Period month from the dropdown in which you want to compute payroll for an employee.

- Select an Employee from the dropdown in which you want to compute payroll for an employee.

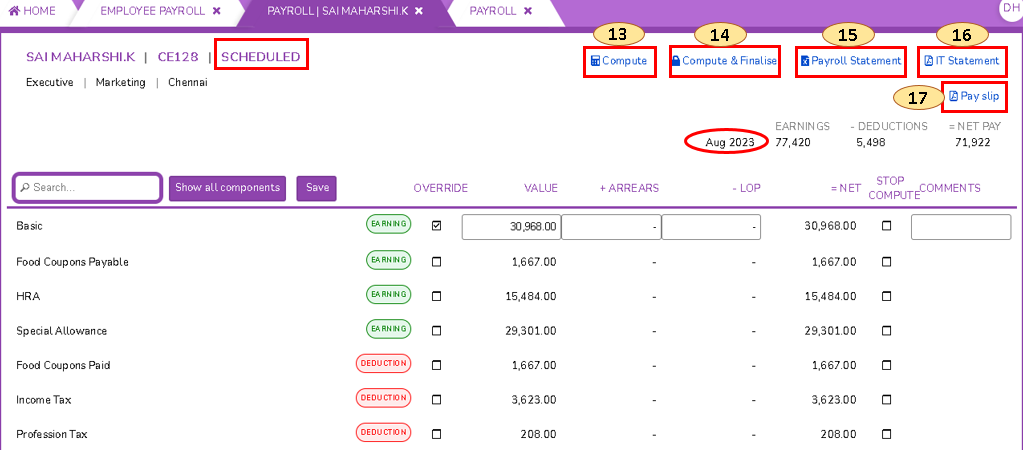

- Override: It is a manual adjustment or modification to an employee's payroll information, earnings, deductions or taxes. Click on the override check box to allow you to override the values as shown in the above screen.

- Value: It is a value or amount

- Arrears: It refers to payments or amounts that are owed to an employee but have not been paid on time.

- LOP: "Loss of Pay" is a reduction in their salary for a specific period because they are on an approved leave of absence that is unpaid.

- Net: It is the difference amount of Gross amount and total expenses or deductions.

- Stop Compute: Click on check box to stop the computation of payroll component.

- Comments:

- Earnings: It is the total amount of compensation paid by the employer and earned by the employee.

- Deductions: It is the total amount of deductions

- Net Pay: It is the difference amount of Total earnings and total deductions to the employee

- Show all components: These are the list of all components that are available for payroll computation

- Save: Click on Save button to save the employee payroll for the month

- Compute: It is the process of calculation of payroll

- Compute & Finalise: It is the process of finalisation of computed payroll process

- Payroll Statement: It is the downloaded excel statement of annual payroll

- IT Statement: It is the downloaded PDF IT statement report

- PaySlip: It is the downloaded PDF Payslip for the month

- Release: It is the process of release the payroll computed & finalised

- Back to Schedule: It is the process of payroll computation revert back to schedule. Please make a note, If Payment was done already then you cannot go back to schedule.

No Comments