How to Add Statutory in Employee Maintenance

Statutory

A statutory employee is an independent contractor who is considered an employee for tax withholding purposes. An individual must meet certain criteria to be considered a statutory employee.

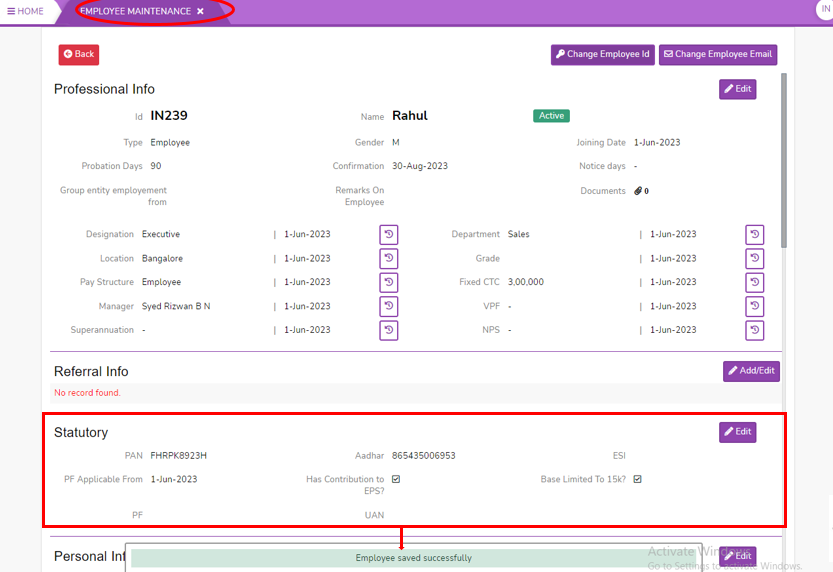

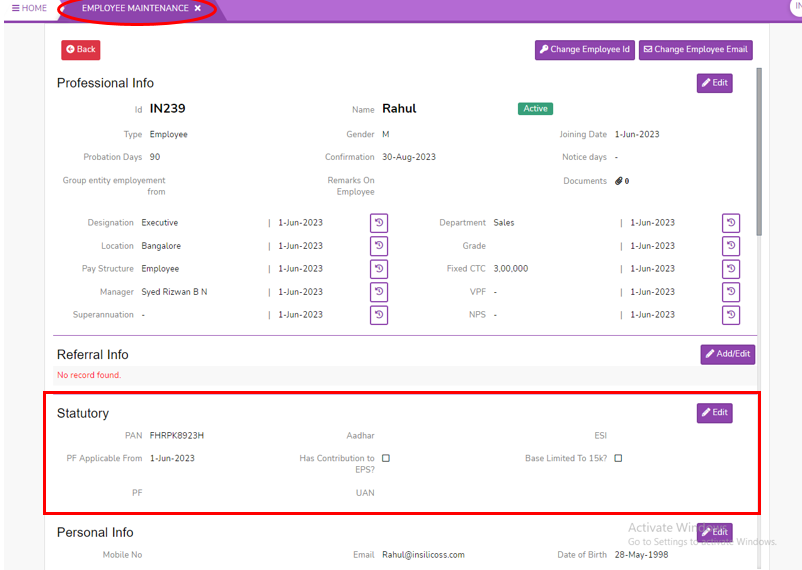

The Statutory page in the SPARC allows you to view and add individual employee statutory details like PAN, Aadhar, ESI, PF and UAN.

To view the Statutory in Employee Maintenance page, Login to SPARC > FunctionsMenu > ClickFavourite on> Employee Maintenance > View > Statutory.

- Login to SPARC as HR

- Open Employee Maintenance menu. Here you can see all the Employee details.

- Select one employee to whom you want to view/edit the details of the employee. Click on View button you can see all the professional and personal details of the employee.

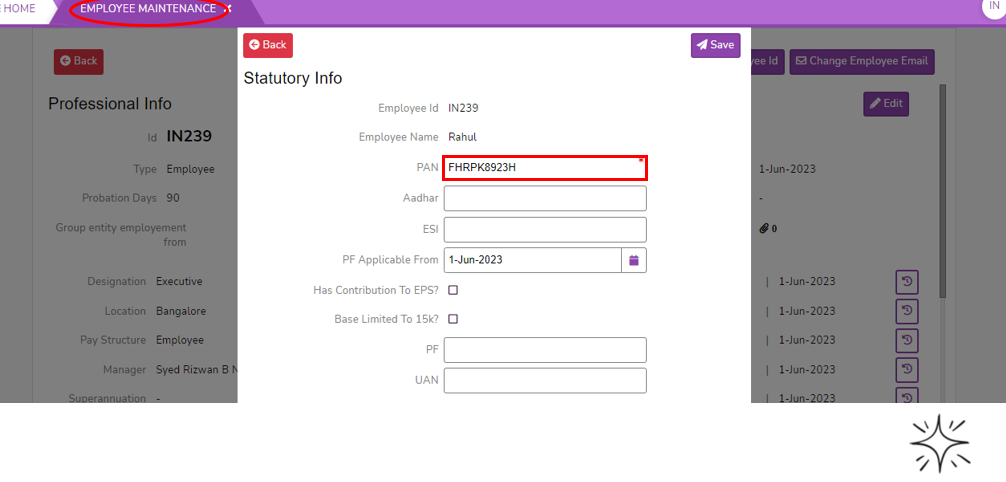

- Click on Edit button, here you can add the statutory details of Employee and the screen looks like below.

-

- PAN

Enter-PAN is a unique identification number issued by the Income Tax Department to individuals, companies, and other entities. It is used for tracking financial transactions and filing income tax returns. PANAadhar - It is a unique 12-digit identification number issued by the Unique Identification Authority ofemployee.India (UIDAI).EnterAadharnumber of employee.EnterESInumber of employee,- It is a scheme is financed by the contributions from employers and employees.-

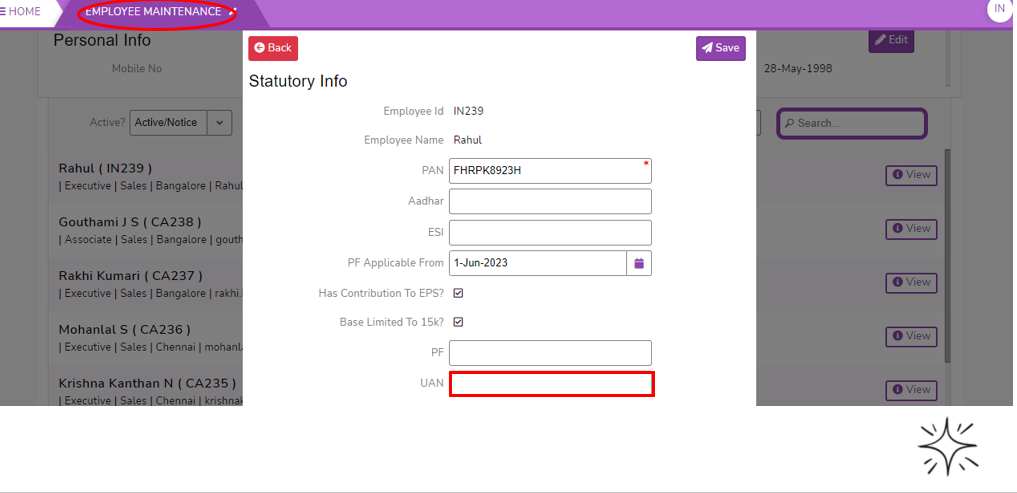

Select the date ofPF Applicable from - It is thecalendar.date the PF account is applicable from Select the employeehas Contribution to EPS? -byEPSclickingrefersticktointhecheckboxEmployeeasPensionYesScheme, which is a part of the Employees' Provident Fund (or)EPF)leaveprogram.it.-

Select the employee hasBase Limited to 15K?by-clickingIttickisinthecheckboxoptionastoYeschoose(or)theleaveemployeeit.has basic CTC 15k and above, they have a option to limit their basic limits to 15k. EnterPFnumber,-itIt is an account number which is used by the employees to check the status of the employee PF and check account balance.-

EnterUANnumber,-itIt is a 12-digit number provided to each employee contributing to the employee's provident fund.

- PAN

-

- Click on Save button to save the Statutory details of Employee