Flexi Plan

Flexible Benefit Plan

Flexible Benefits Plan (FBP) allows employees to choose the benefits they want or need from a package of programs offered by an employer. It’s the part of the salary that allows employees to modify the components of their CTC (Cost to the company). FBP allows the employees to have better control over their plans and hence better control over their lives. They can decide which components of the CTC they want to opt into and how much each component.

Components of FBP

Employee benefits program where the employer offers a set package of benefits to all employees. Unlike a "Flexi Benefit Plan," where employees can choose from a range of benefits. The components of a Fixed Benefits Plan typically include:

Food Coupons : In fields where the employees need to travel a lot for work, it’s common for companies to have meal or cafeteria bills under their flexible benefits plan.

Leave Travel Allowance (LTA) : It is a type of allowance which is provided by the employer to his employee who is travelling on leave from the work to cover his travel expenses.

Child Education Allowance : It is a financial benefit provided by some employers to their employees to support the education expenses of their children.

Conveyance : This may include vehicle lease, fuel bills, chauffeur service, and cab costs. An employee may opt-in for this if their commute to work takes up significant time and cost every day. etc.,

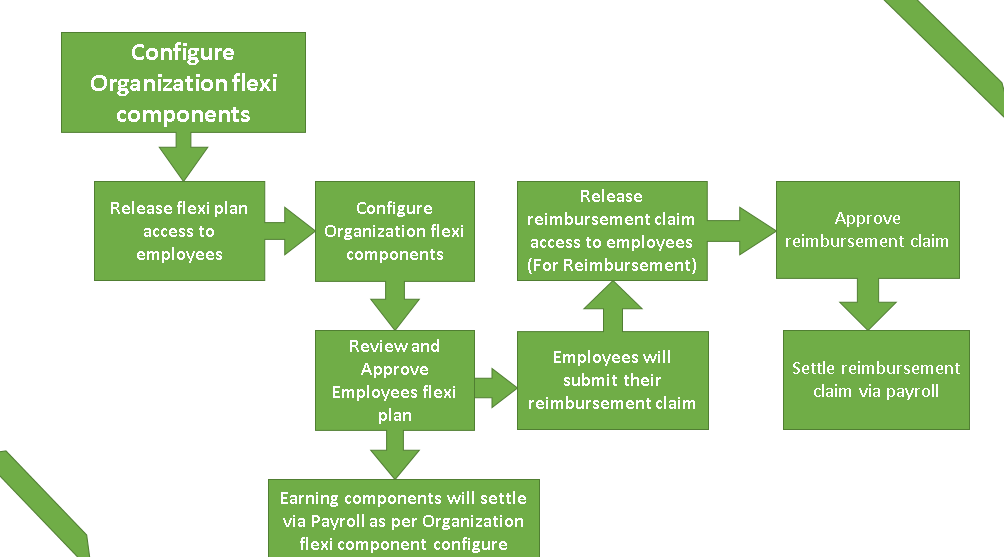

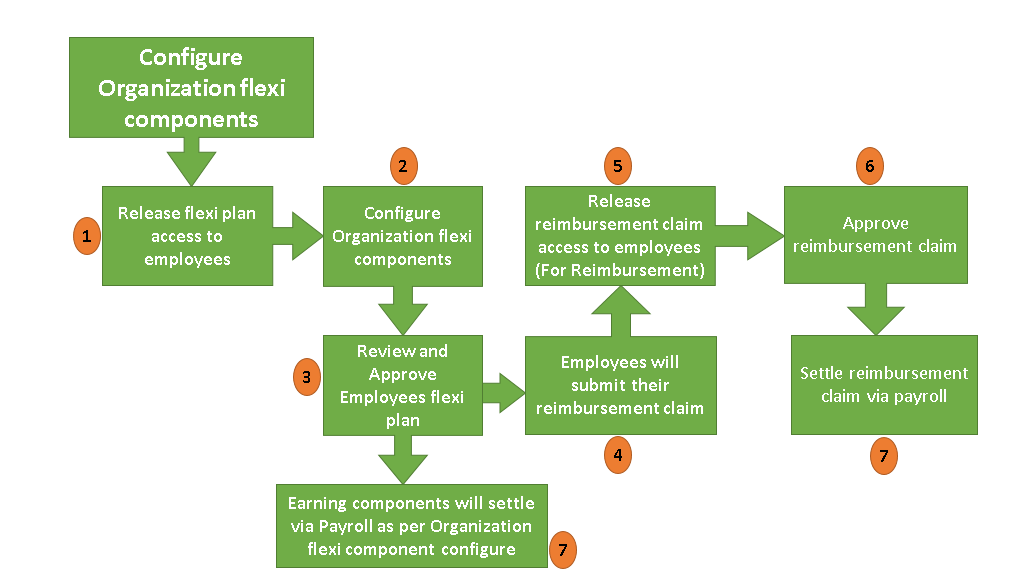

Here is the Flexible Benefit plan work Flow chart looks like the below screen.

To configure organisation flexi components, the following steps to be involved:

- Release flexi plan access to employees

- Configure organisation flexi components

- Review and approve employee flexi plan

- Earning component will settle via payroll as per organisation flexi component configure

- Employee will submit their reimbursement claim

- Release reimbursement claim access to employee (for reimbursement)

- Approve reimbursement claim

- settle reimbursement claim via payroll