How to add employee loan?

Employee Loan

An employee loan, also known as a salary advance or payroll loan, is a type of loan provided by an employer to its employees. It allows employees to borrow money from their employer to meet immediate financial needs or emergencies. The loan amount is deducted from the employee's future salary or wages, typically in instalments, until the loan is fully repaid.

The Employee Loan page in the SPARC allows you to view and add individual employee professional details of the employees.

To view the Employee Loan in Util page, Login to SPARC > Menu > Util > Click on Loans.

In SPARC employee loan starts by HR entering loan details in to SPARC and the steps are as follows

- Login to SPARC as HR

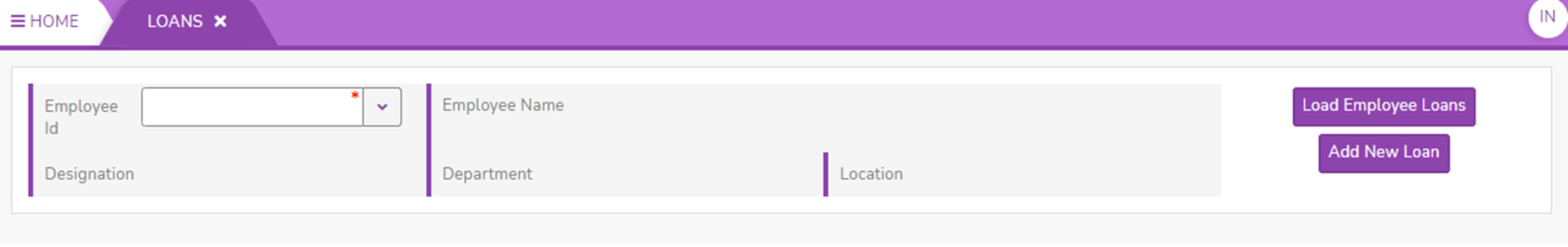

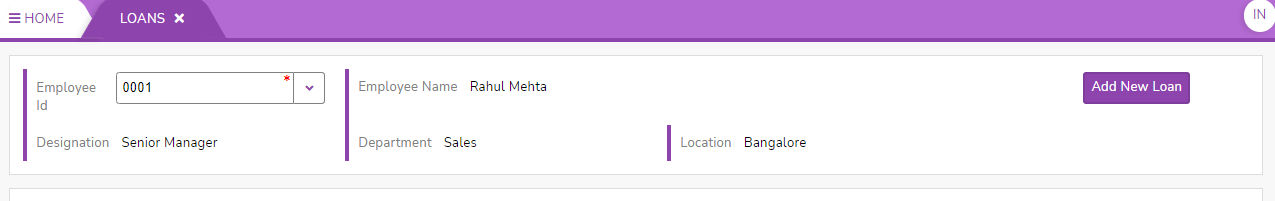

- Go to Util Menu and Click on Loan function

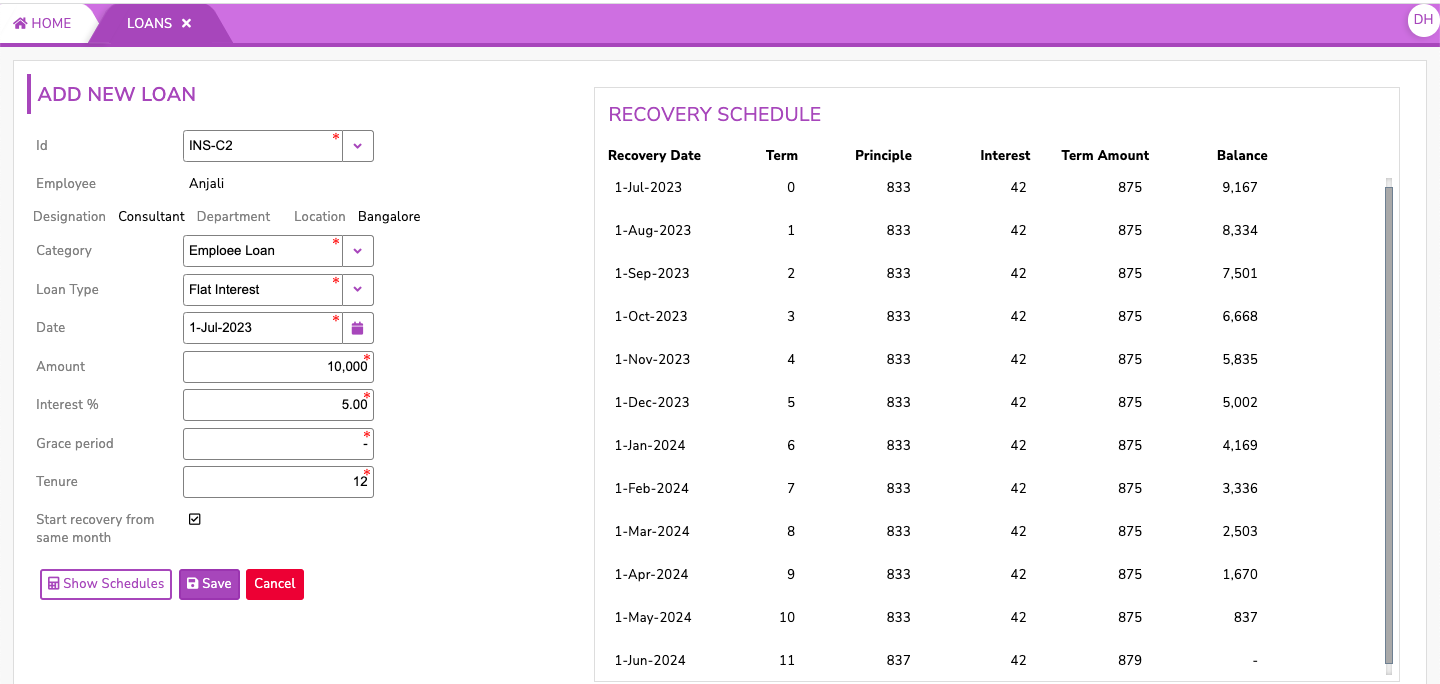

- Enter Employee ID and then click on Add New Loan

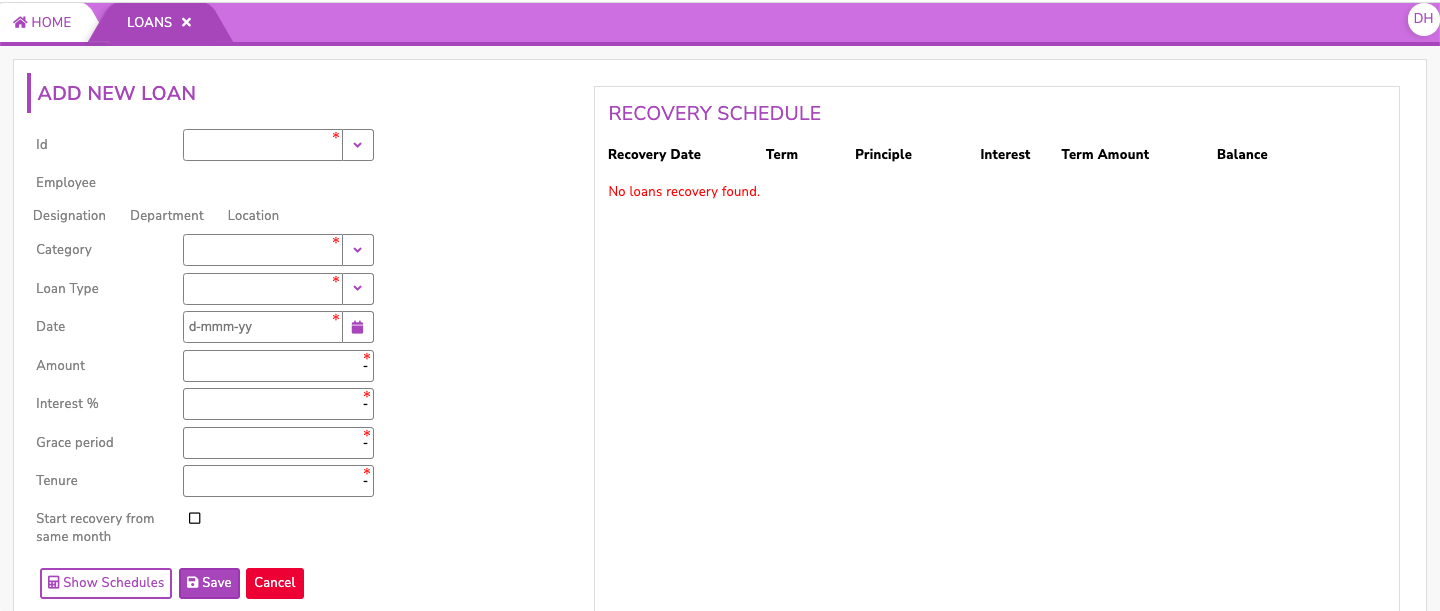

- Fill the following details -

- Category : Fill Category as Employee Loan

- Loan Type : Loan Type refers to classification by which interest is charged

-

Flat Interest : A "flat interest loan" refers to a type of loan where the interest is calculated based on the original loan amount throughout the loan's duration.

-

Reducing Interest : It refers to a method of calculating interest on a loan or credit facility where the interest is charged based on the outstanding balance of the loan. This leads to a gradual reduction in the overall interest cost and the duration of the loan.

-

- Date : Select the date from when the Loan is applicable

- Amount: Enter the loan amount in Rupees

- Interest % : Rate of Interest

- Grace Period : A grace period, refers to a specified period of time during which a Employee is not required to make payments on the loan or is exempt from certain penalties.

-

Enter grace period as -1 if you want deduction to start from the same month in which loan granted.

-

- Tenure : "Tenure" typically refers to the length or duration of a loan

- Start recovery from same month - by clicking the checkbox you can start recovery from the same month.

- Click on Show Schedule to view Recovery Schedule

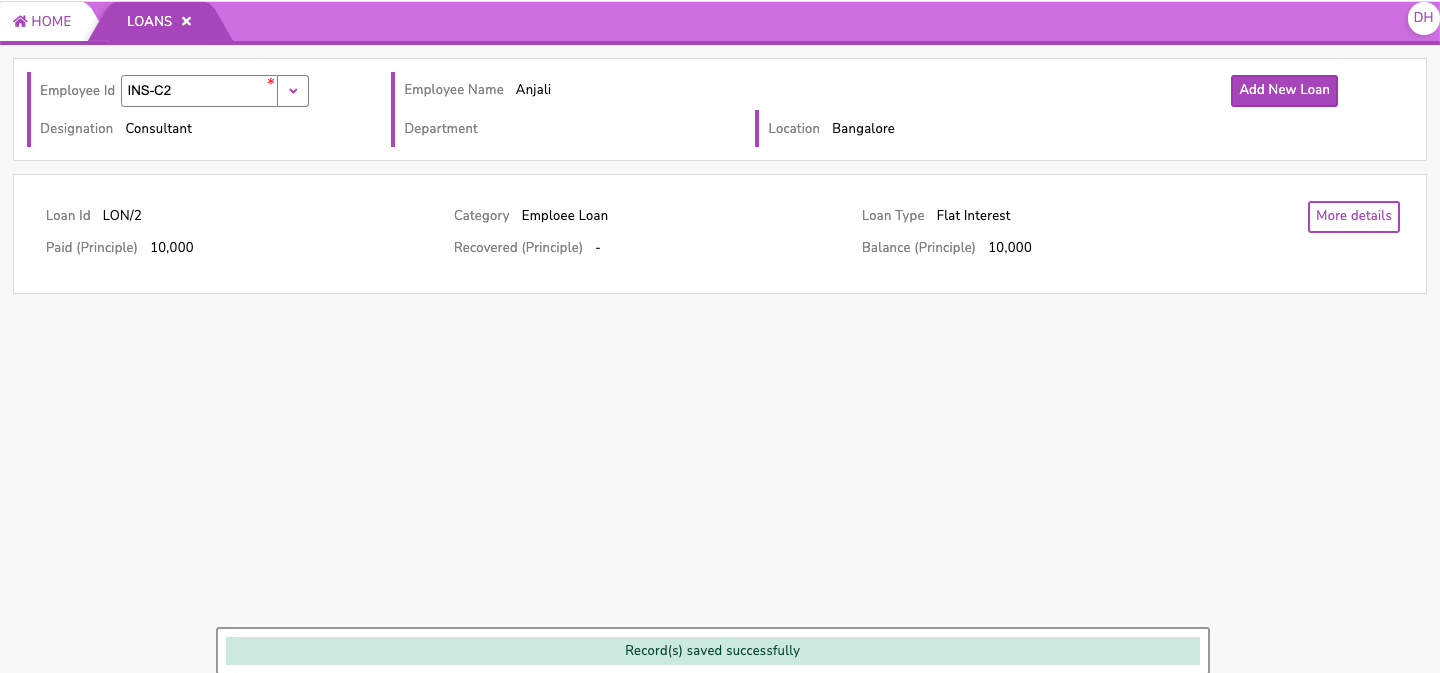

- Click on Save button to save the loan or click cancel to cancel. Post save you can see the screen below.