How to add employee loan?

- Login to SPARC as HR

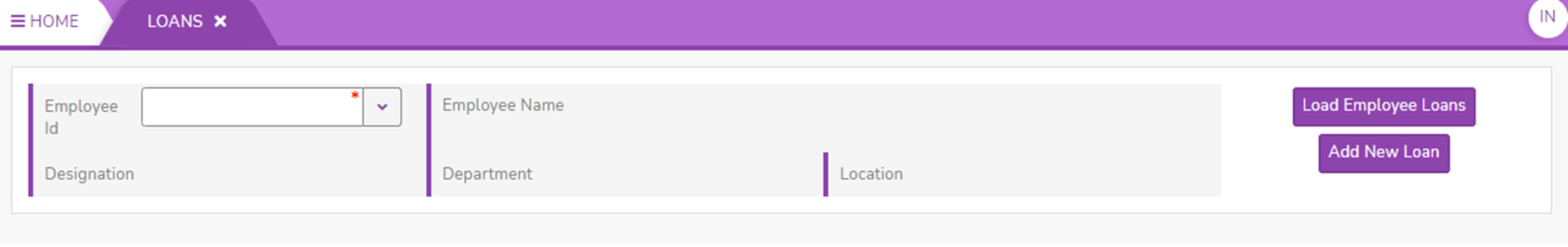

- Click on Loan function

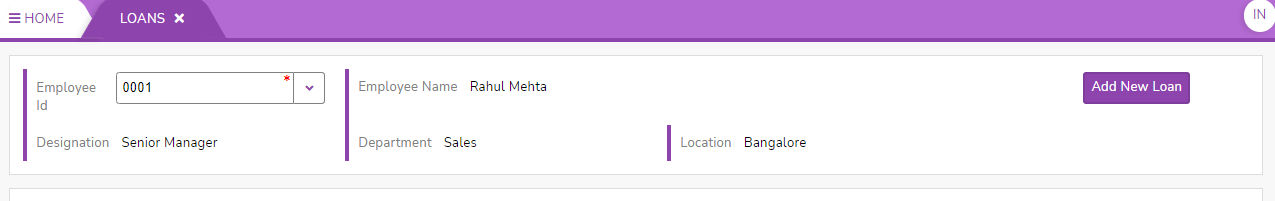

- Enter Employee ID and then click on Add New Loan

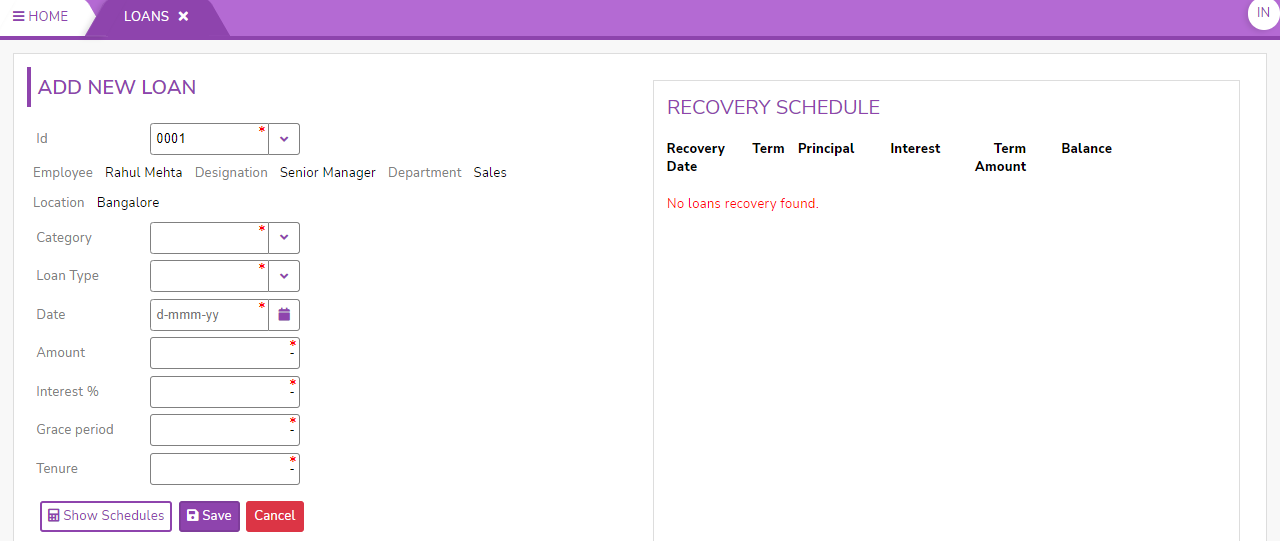

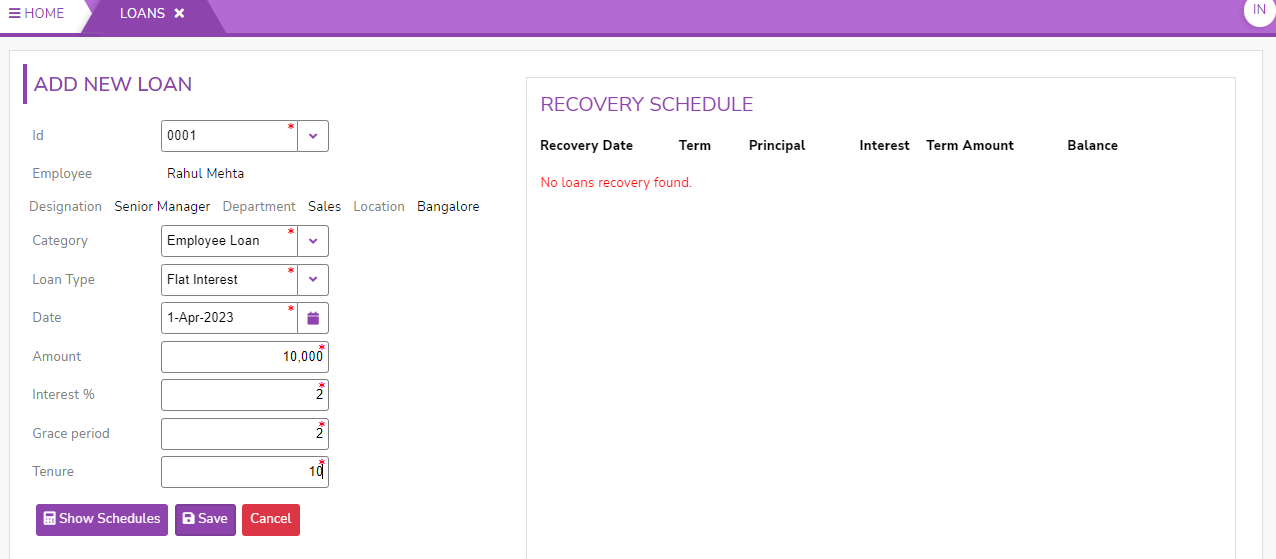

- Fill the following details -

- Category : Fill Category as Employee Loan

- Loan Type : Loan Type refers to classification by which interest is charged

-

Flat Interest : A "flat interest loan" refers to a type of loan where the interest is calculated based on the original loan amount throughout the loan's duration.

-

Reducing Interest : It refers to a method of calculating interest on a loan or credit facility where the interest is charged based on the outstanding balance of the loan. This leads to a gradual reduction in the overall interest cost and the duration of the loan.

-

- Date : Select the date from when the Loan is applicable

- Amount: Enter the loan amount in Rupees

- Interest % : Rate of Interest

- Grace Period : A grace period, refers to a specified period of time during which a Employee is not required to make payments on the loan or is exempt from certain penalties.

- Tenure : "Tenure" typically refers to the length or duration of a loan

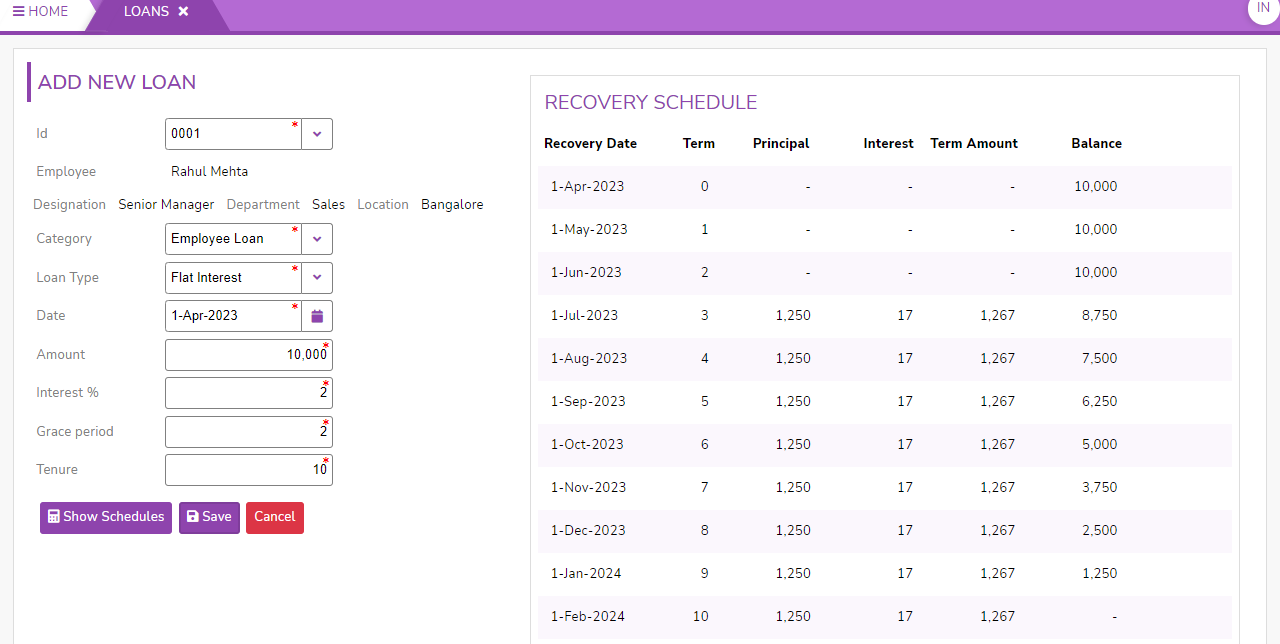

- Click on Show Schedules.

- You can find the Recovery Schedule calculation sheet with the Grace period 2 months

- You can save the calculation sheet

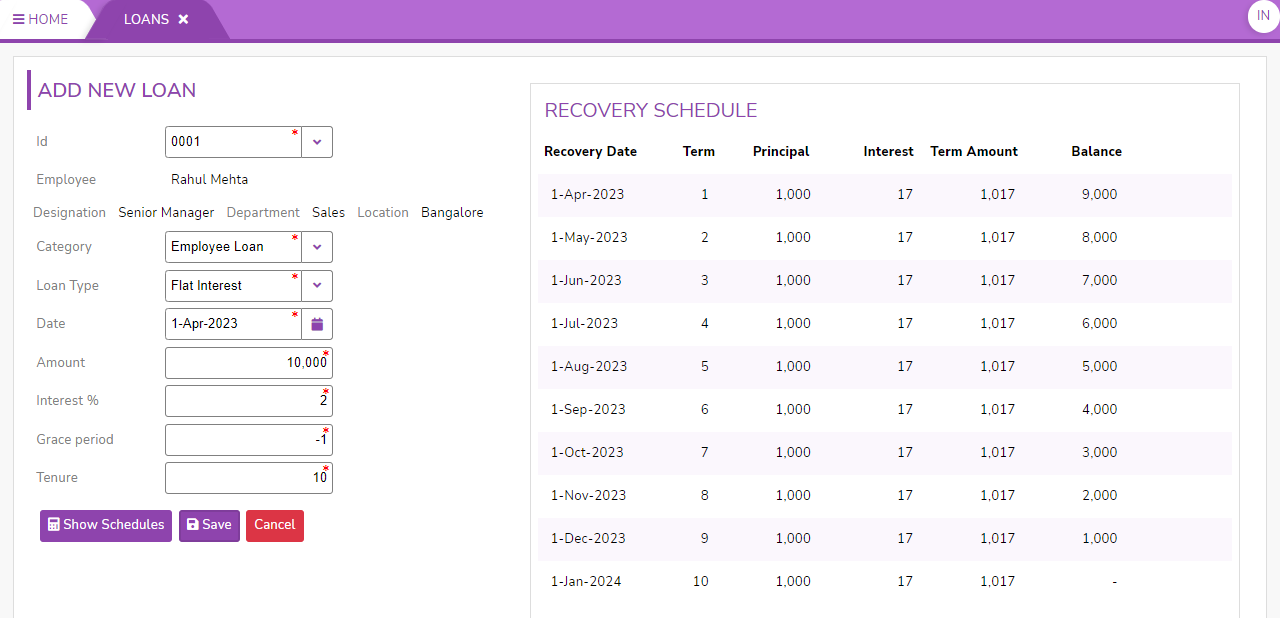

- Enter grace period as -1 if you want deduction to start from the same month in which loan granted.

- You can find the Recovery Schedule calculation sheet with the Grace period -1

- You can save the calculation sheet

- cancel to Exit