Ad-hoc Payroll Input

Ad-hoc payroll input refers to the process of adding or processing payroll input on an irregular or one-time basis.

Some of the examples of Ad-hoc inputs are -

- Annual Bonus, which is a financial incentive or reward provided to employees by their employer on an annual basis. It is a form of additional compensation beyond the regular salary or wages and is typically based on individual or company performance, or a combination of both

- Incentive, which is something offered to motivate or encourage a desired behavior, action, or outcome

- Joining Bonus, which is also known as a hiring bonus, is an incentive offered to a newly hired employee as an enticement to accept a job offer and join a company

- Retention Bonus, which is an incentive offered to employees to encourage them to stay with a company for a specific period of time

- Reward

- Other Earnings

- Other Deductions

The Ad-hoc payroll Input page in the SPARC allows you to view, add in bulk, add for each employee, and delete the ad-hoc payroll input details of the employees.

To view the Ad-hoc payroll Input page, Login to SPARC > Functions > Click on Ad-hoc Pay Inputs.

You can perform the following steps on the Ad-hoc Payroll Inputs page:

- View Ad-hoc payment paid details of an employee.

- Add Ad-hoc pay inputs in bulk.

- Add Ad-hoc pay inputs for each employee.

- Delete Ad-hoc pay inputs of an employee.

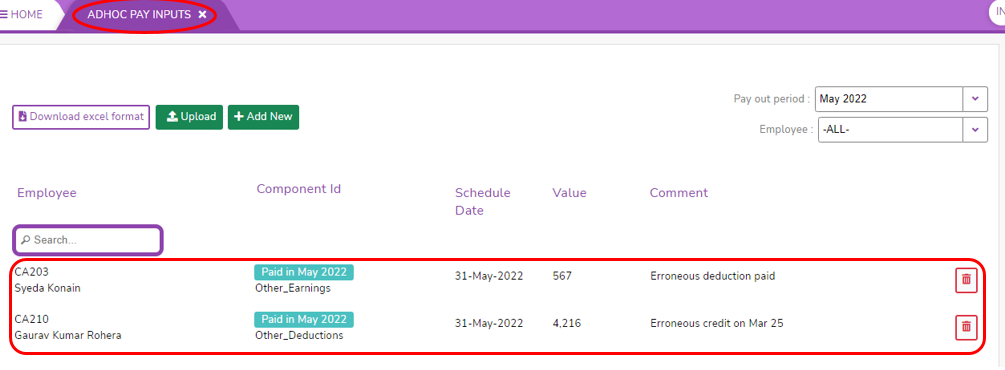

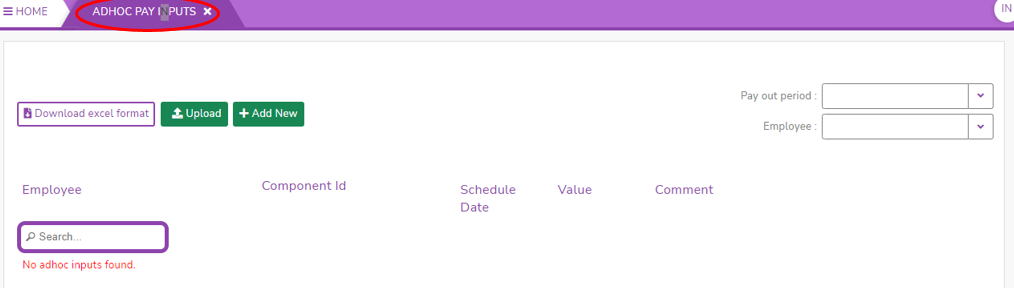

1. How to View Ad-hoc Payment paid details of an Employee

- Login to SPARC as HR.

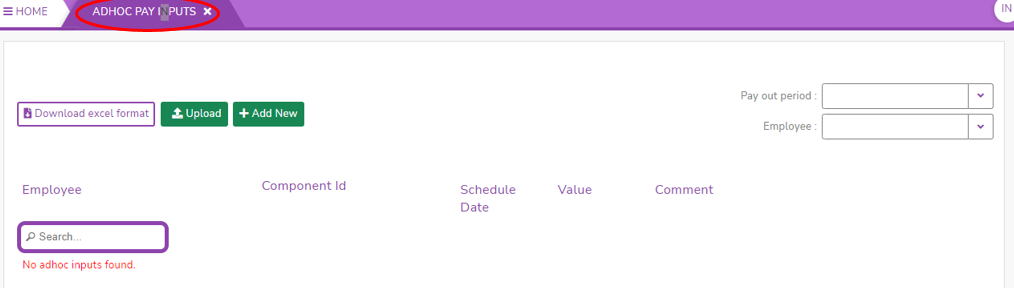

- Open the Ad-hoc Pay Inputs menu. Here you can see all the Ad-hoc input payment details.

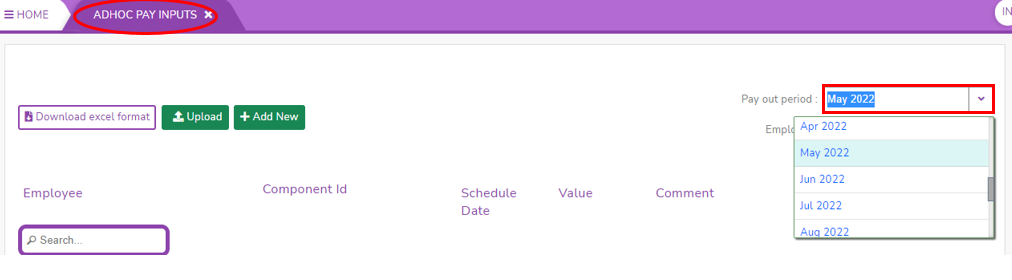

- Click on the Payout period dropdown list to select the month you want to view.

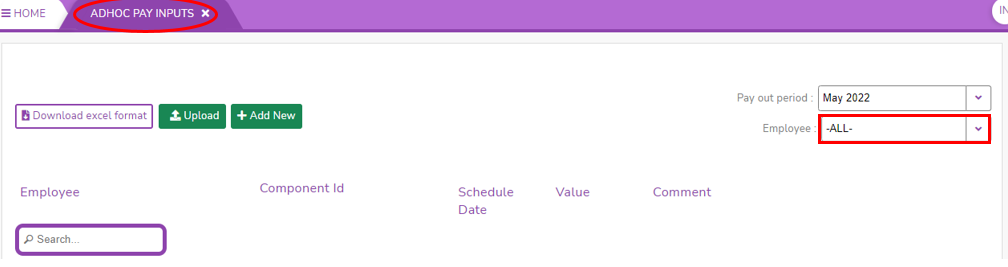

- Click on the Employee dropdown list to select the employee to whom you want to view the ad-hoc payroll paid.

- Here you can see the Ad-hoc paid details for the selected month.

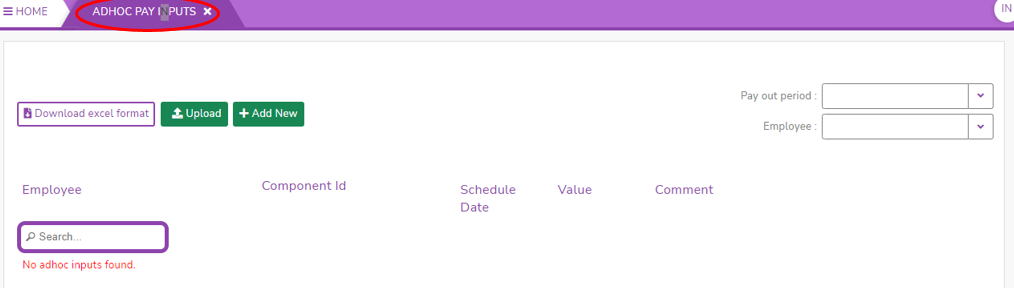

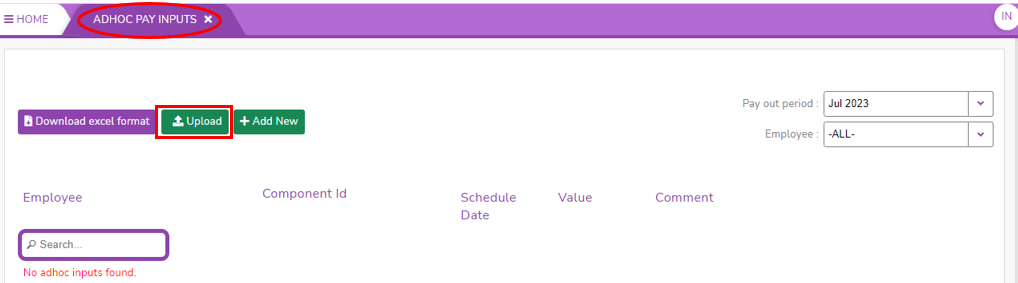

2. How to Add Ad-hoc Payment input details in Bulk

- Login to SPARC as HR.

- Open the Ad-hoc Pay Inputs menu. Here you can see all the Ad-hoc input payment details.

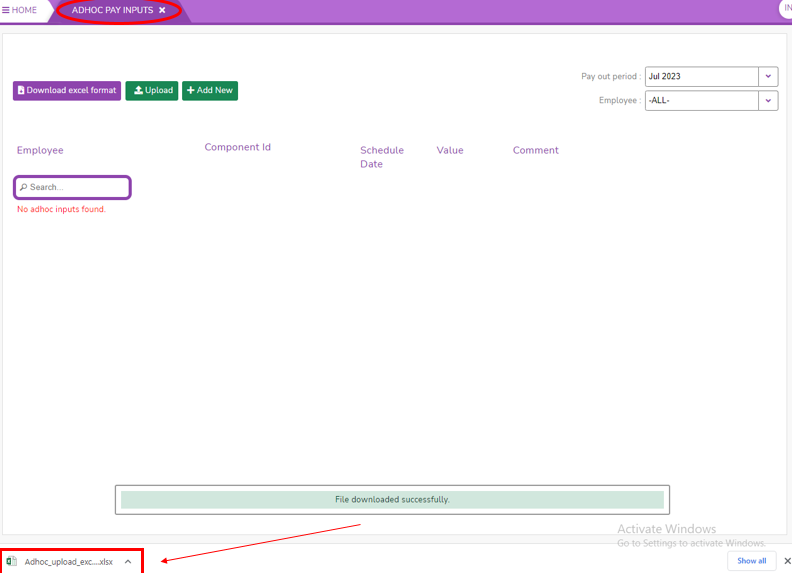

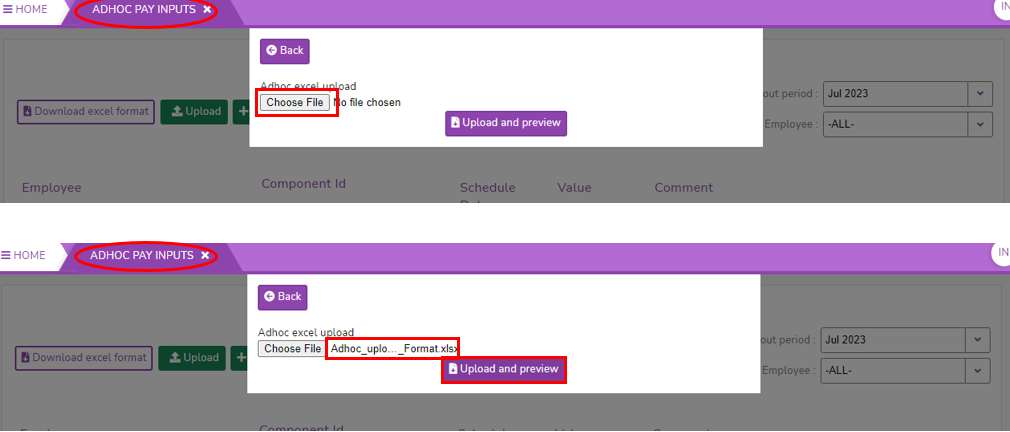

- Click on Download Excel format, you can find an Excel file downloaded in downloads.

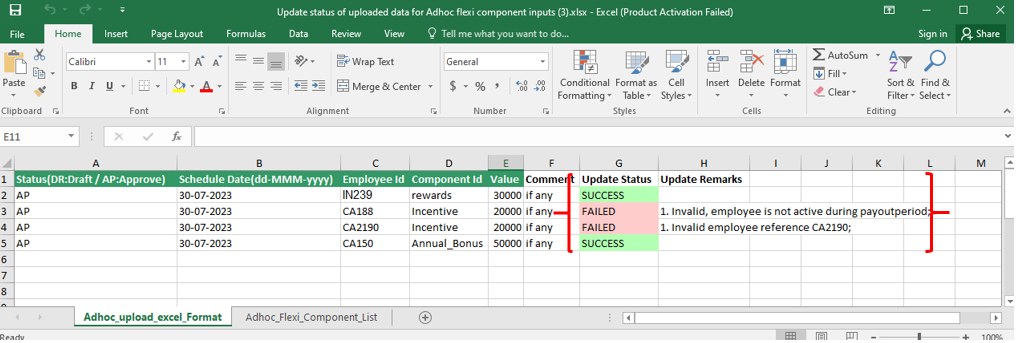

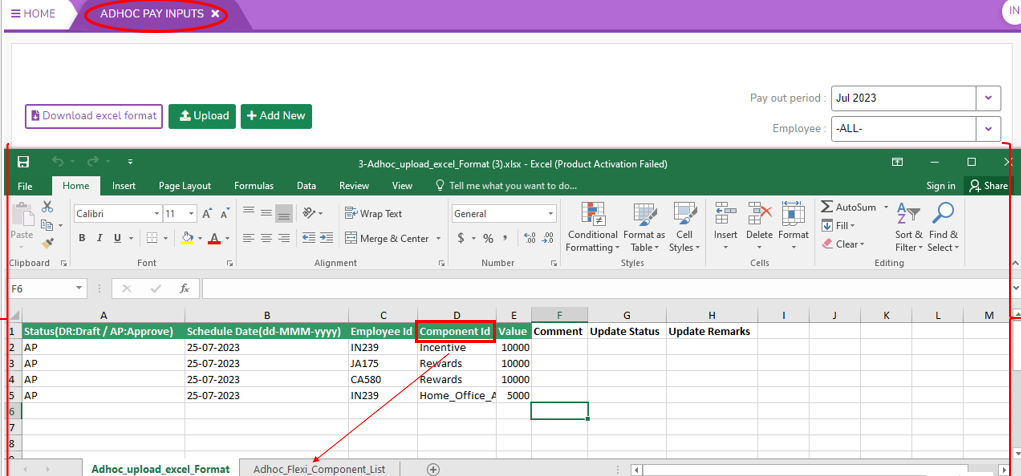

- Open the Excel file and fill in the details of status, scheduled date, employee Id, component Id (which we choose from another sheet of the Ad-hoc component list), value, and comment.

- Upload the above Excel sheet.

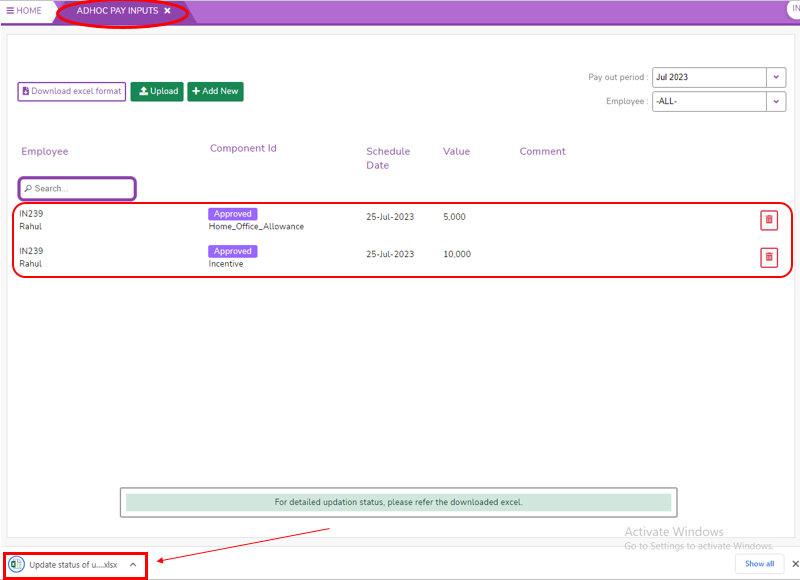

- Once you uploaded the Excel sheet, the screen looks like below. You can see the detailed updation sheet in downloads.

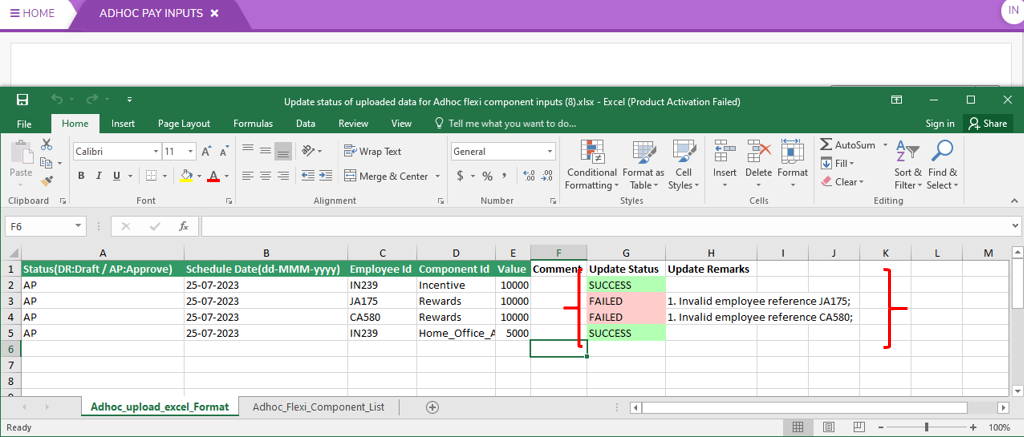

- In the downloaded updation sheet we can check the update status and update remarks like the below screen.

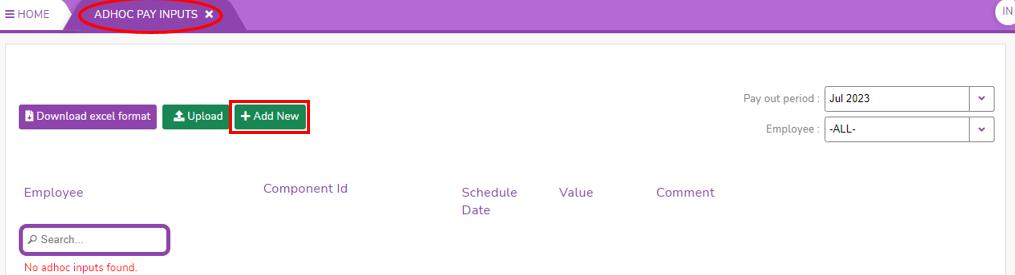

3. How to Add Ad-hoc Payment input details for each employee.

- Login to SPARC as HR.

- Open the Ad-hoc Pay Inputs menu. Here you can see all the Ad-hoc input payment details.

- Click on Add New button, if you want to do a particular employee only.

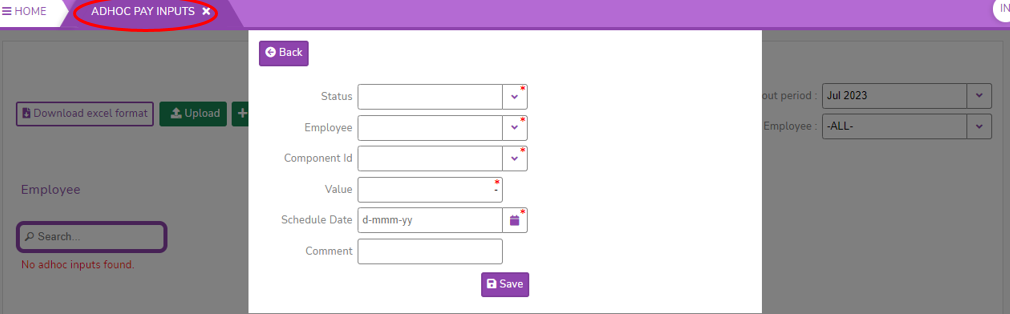

- the screen looks like this.

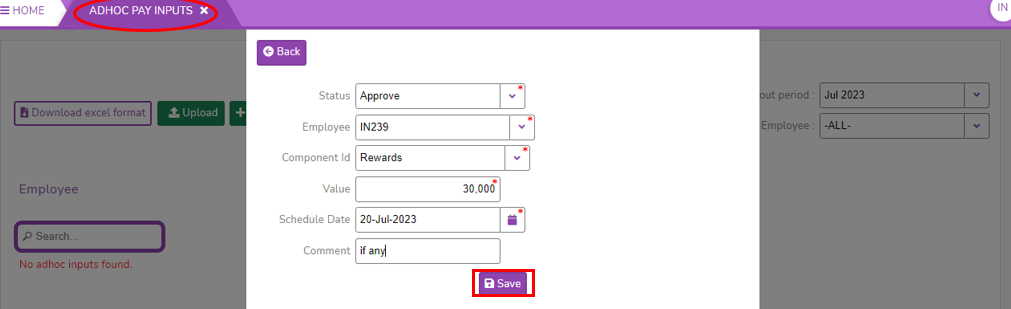

- Select the status of ad-hoc payroll input, select the employee, select component id, value in amount, select the scheduled date from the calendar and enter comments if any. Click on the Save button to save the ad-hoc payroll details of the employee.

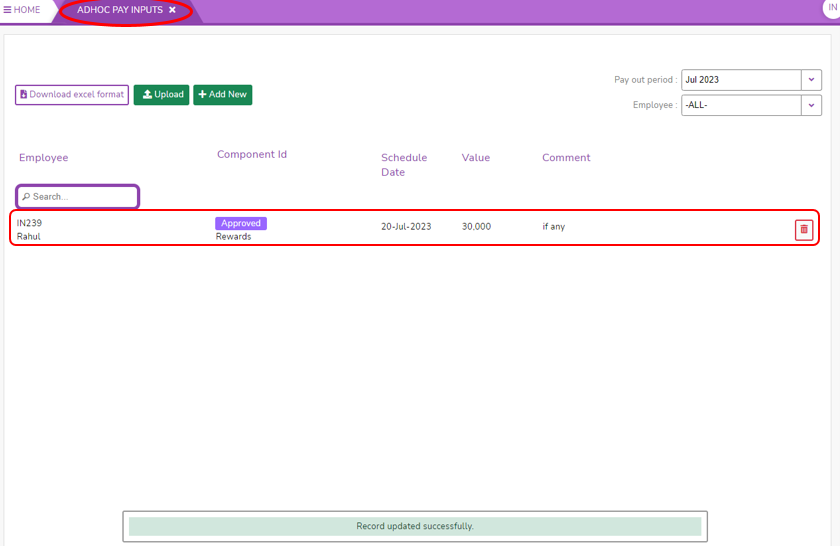

- Post save the screen looks like this.

4. How to Delete Ad-hoc Payment input details of an employee.

- Login to SPARC as HR.

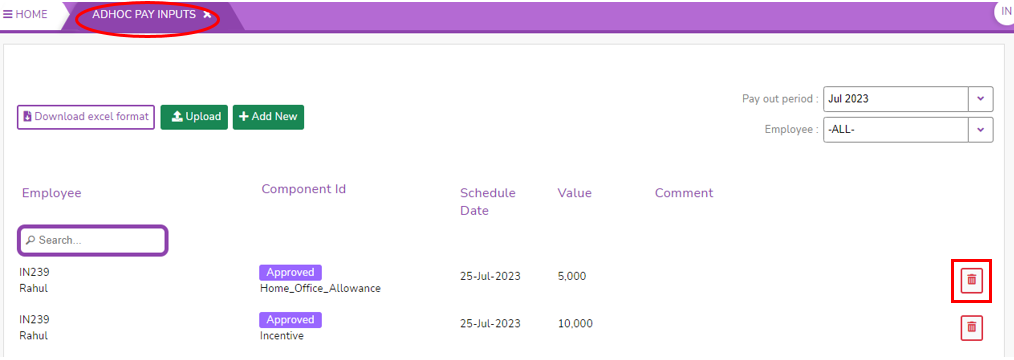

- This is the screen of the Ad-hoc pay input page. Click on the Delete button to delete the employee ad-hoc paid details.

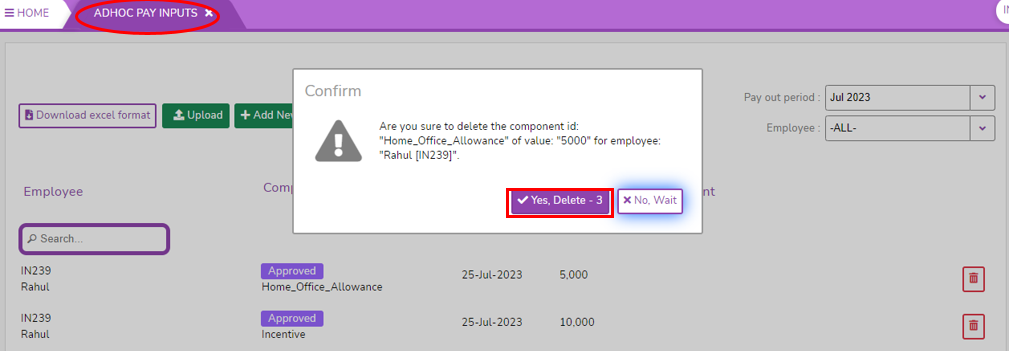

- Once you click on the delete button, It will ask you to delete the confirmation. Click on Yes, Delete.

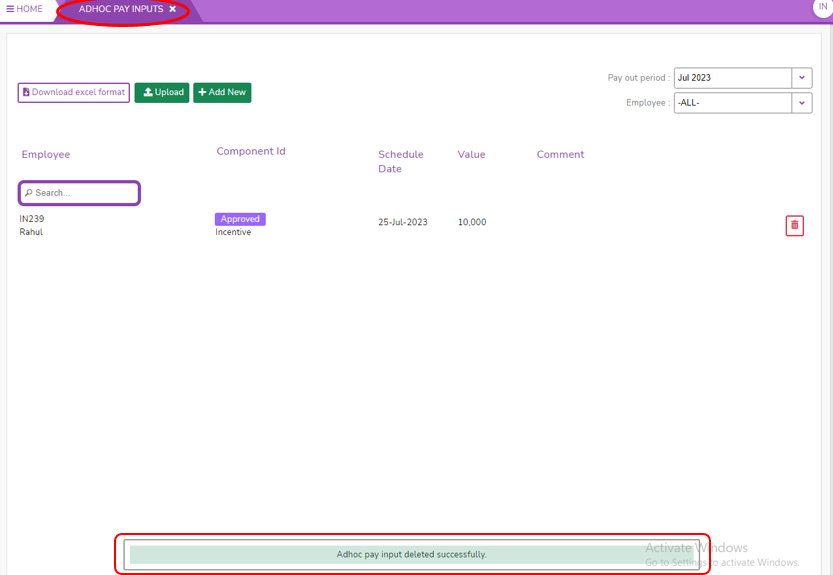

- Post delete the screen looks like this.

Select the Employee from the filter. If you want to select all the employees you can select the All option.Click on Download Excel format, you can find an Excel file downloaded in downloads.Upload the above excel sheet.This is the screen of a detailed updation sheet where we can find the update status and update remarks.